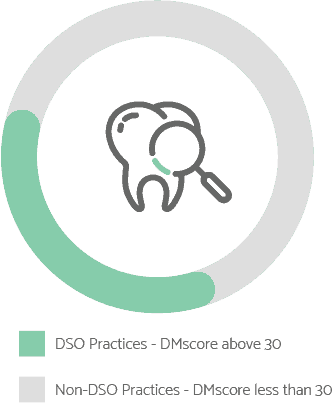

60% of non-DSO practices have DMscores under 30

Dental Service Organizations already figure large in US dentistry—and they have for some time. But DMscore research suggests that in an increasingly competitive market, they are poised to play an even bigger role. There are many reasons for this, but what becomes obvious by looking at the data is that they deliver significantly better digital marketing ROI than any lone practice. According to Dental Care Alliance, even as the dental industry is growing at a rate of 5.5%, DSO-affiliated practices are growing at a much more robust 18%.

DSOs are designed to let dentists be dentists. They deliver every type of service required by the practice except dentistry itself and assist practices across the nation with key front and back office administration and marketing.

According to the American Dental Association, about 9% of dental practices in the US were part of a DSO as of 2017. In 2015 the percentage was 7.4%–indicating a meaningful year-over-year increase. Practices run by women were a significantly larger percentage of DSO practices—11.4% as opposed to 7.3% that are run by male practitioners. There are also significant age-related factors. Over 17% of DSO-participating practices were by dentists under the age of 35, the digital natives – or those who grew up using digital tools.

DSOs Deliver Better Marketing ROI

At DMscore, we intersect with DSOs (and all dental practices) at the corner of marketing and patient-acquisition. DMscore ranks the marketing footprint of professional services companies, comparing them against their local competitors.

We look for strength in areas like Google Ads spend, SERP (Search Engine Results Pages) and Directory presence. A DMscore is like a FICO Score™, but for digital marketing performance and ROI. Our algorithm weighs a number of key factors to determine the score. By monitoring their DMscore and looking at our suggestions as to where to focus digital marketing improvements, dental practices can optimize their effectiveness at gaining more customers than their local competition. Agencies that develop marketing programs for dental practices can also monitor an improving DMscore, and can use it as a benchmark to monitor their work product. DMscores range from 0-100.

Recently we compared the relative scores of 54,000 DSO-affiliated practices with those that are not affiliated with the larger organizations. What we found, generally, is that DSO-affiliated practices clearly tend to have higher DMscores.

- 60% of non-DSO practices have DMscores under 30 (out of 100).

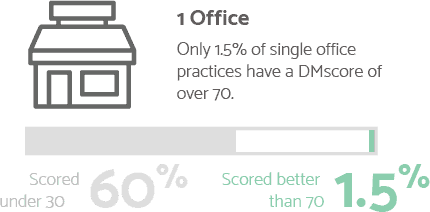

- Only 1.5% of lone practices score a DMscore of 70 or higher.

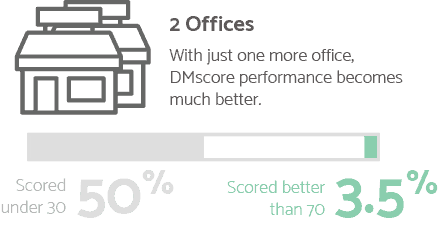

- The numbers get much better with practices with two offices. 45% had scores under 30 and 3% of these scored better than 70, which is double that of single offices.

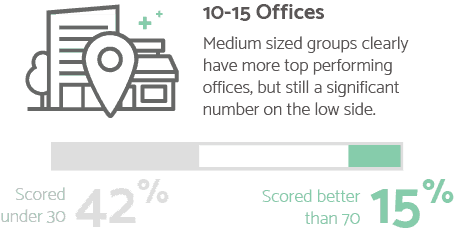

- Practices with at least 15 locations had higher DMscores, with 40% under DMscore of 30 and 15% over 70.

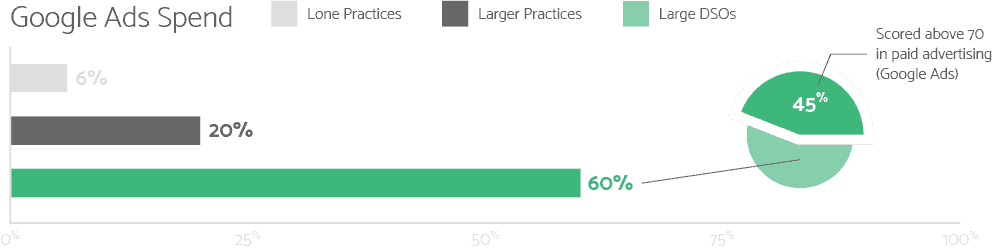

One of the most notable differences is that DSO-practices (Western Dental, for instance) are much more likely to spend heavily on Google Ads than individual practices. In fact, the gap between lone practices and DSO practices in Google Ads spend is enormous. Only 6% of lone practices are buying Google Ads! About 20% of larger practices with more offices buy Google Ads. By contrast, 60% of large DSOs commit dollars to buying Google Ads—a tenfold increase in Google Ads buying as compared with the lone practitioner. Fully 45% of DSO-affiliated locations scored above 70 in paid advertising (aka Google Ads).

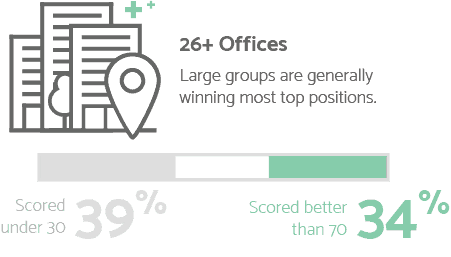

Our research continues to reveal that size does matter when it comes to marketing. Larger DSOs (those with more than 25 offices) fare best. We found that 38% of these scored better than 70, while 50% scored between 40 and 70 (out of 100).

DSOs have greater leverage in general.

We found that many of them support more than one internet domain (web address) for a single office, giving them the ability to deploy parallel marketing plans that may deliver more than one DMscore per office location.

Perhaps most importantly, 58% of DSO offices are in the top 3 marketing positions for their location!

All of this suggests it will be increasingly difficult for unaffiliated practices to compete for patients—cementing the primacy of DSOs going forward unless competitive measures are undertaken today.

![]()

Small Practices Can Still Effectively Compete if They are Aggressive in Marketing Today

All of the above notwithstanding, we are also seeing opportunities in specialization—and the purchase of “long tail” ad keywords to support it.

By “long tail” we mean those keywords or combinations of keywords that are much more specific (pediatric maxillofacial surgery, for instance) rather than general (like “dentistry”). Long tail has been the haunt of smaller, specialized businesses for years, and careful spending on the right keywords can deliver valuable traffic to even the smallest practitioner.

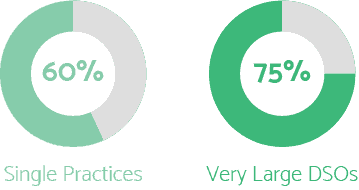

We tested 20 dental related, long tail keywords; and found that when we test these keywords, 65% of single practices or small offices manage to appear on the first page of search results—an outstanding achievement. The same statistic is 75% for very large DSOs—better, but not that much better. This suggests that DSOs have taken up all of the inventory of keywords with general, or “global” reach; while well-thought out campaigns using very specific (long tail) keywords are still within reach for the lone practitioner.

First Page of Search Results (20 dental related, long tail keywords)

With COVID-19 having sidelined many dentists, is it time for practitioners to take a careful look at their digital marketing? The current situation will not last forever, and the landscape may be different once it’s over.