With digital marketing effectiveness data on over 54,000 dentists nationwide, DMscore has identified a number of significant gaps in dental practice digital marketing.

DMscore’s premise is simple: how is your practice’s digital marketing doing in comparison with your local competitors? We produce a score for each practice. The score ranks certain aspects of a practice’s digital marketing footprint as it stands in relation to its local competitors.

“DMscore is a new way of measuring and monitoring digital marketing performance and local competition,” says Rand Schulman, CEO of DMscore. “We are completely data driven and an objective way to track your efforts and competition.” says Rand Schulman, CEO of DMscore.

Here is what we found, based on the data we’ve collected on practices in over 3,000 cities and towns across the United States.

Directories Like Yelp are Important, but Too Many Dentists Ignore Them

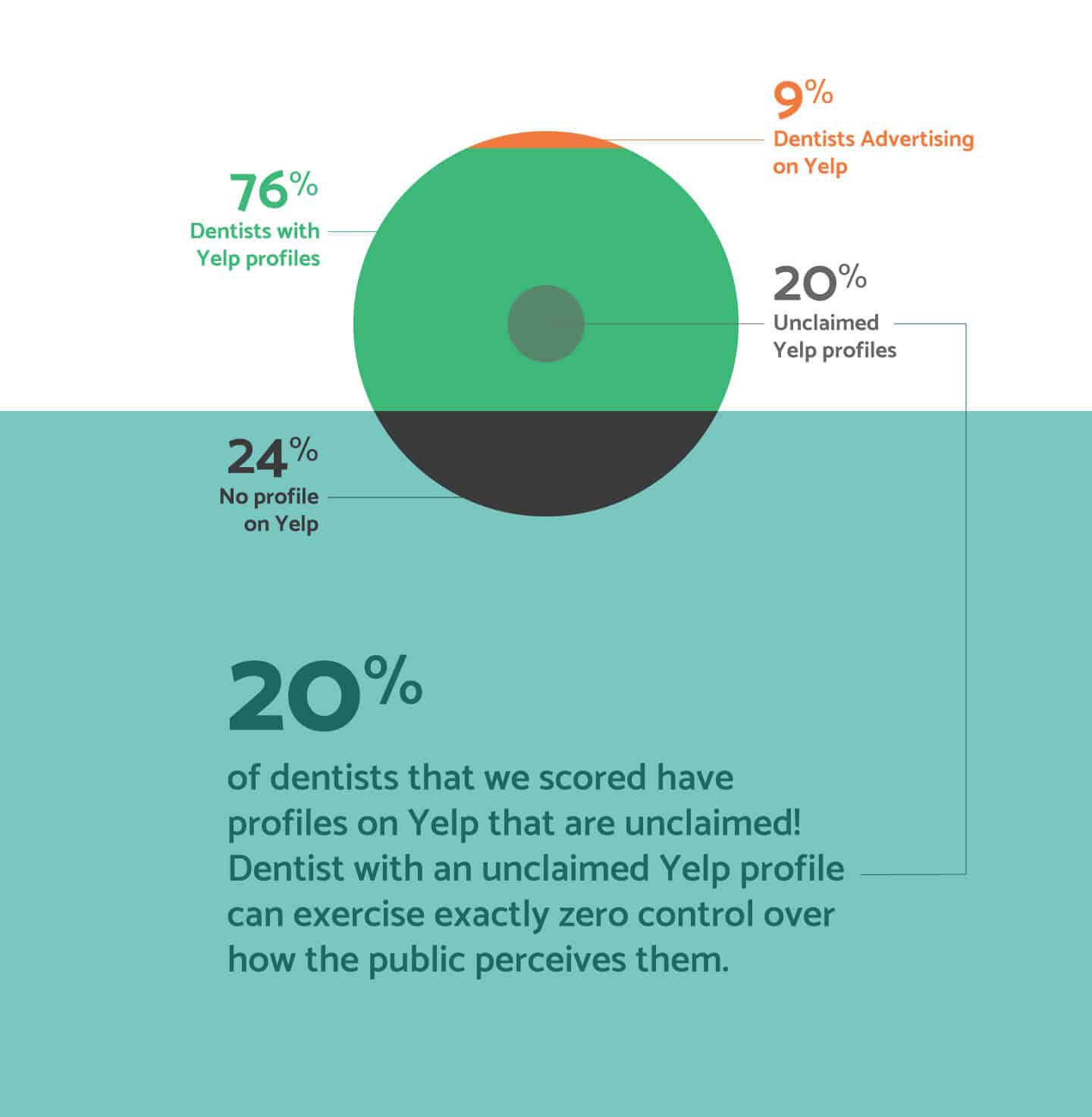

We found that of the dentists we “scored,” 76% of them had profiles on Yelp – but 20% of these profiles are unclaimed! This means that the dentist with an unclaimed Yelp profile can exercise exactly zero control over how the public perceives them. Yelp’s own marketing says that businesses claiming their own profile on the platform can “respond to reviews with a direct message or a public comment” and “track the user views and customer leads Yelp is generating.”

Perhaps more surprising, only 9% are advertising on Yelp. In fact, we saw a small decrease in Yelp advertising since September 2019.

Yelp provides a way for the dentist to describe their own practice; and to reply to or challenge negative reviews. A dentist deeply involved in growing their practice with digital marketing will take this one step further and embrace reviews from happy clients. Certainly they will also advertise on Yelp, because this is where their future patients are trying to find them!

If you’re a dentist and you’ve not claimed your Yelp profile, you are at the mercy of the public and there may even be false or misleading information on the web about your practice because of it. And if we add up the 24% not found on Yelp plus the additional 15% with unclaimed profiles, that shows that almost 40% of all dentists with either no presence on Yelp, or a limited, vulnerable exposure to Yelp reviews.

The takeaway? Dentists need to take control of their own online reputations in a more robust manner generally than is currently the case.

“Today’s dental practices depend on digital marketing to find new customers and retain old ones,” says Schulman. “To do that, you must make a meaningful impression where it matters on platforms your patients and prospects trust and use on a daily basis like Facebook, Google, Twitter, and Yelp. Like your Google search rankings, your DMscore can fluctuate so it’s important to keep monitoring it.”

Directory Presence Differs by Region

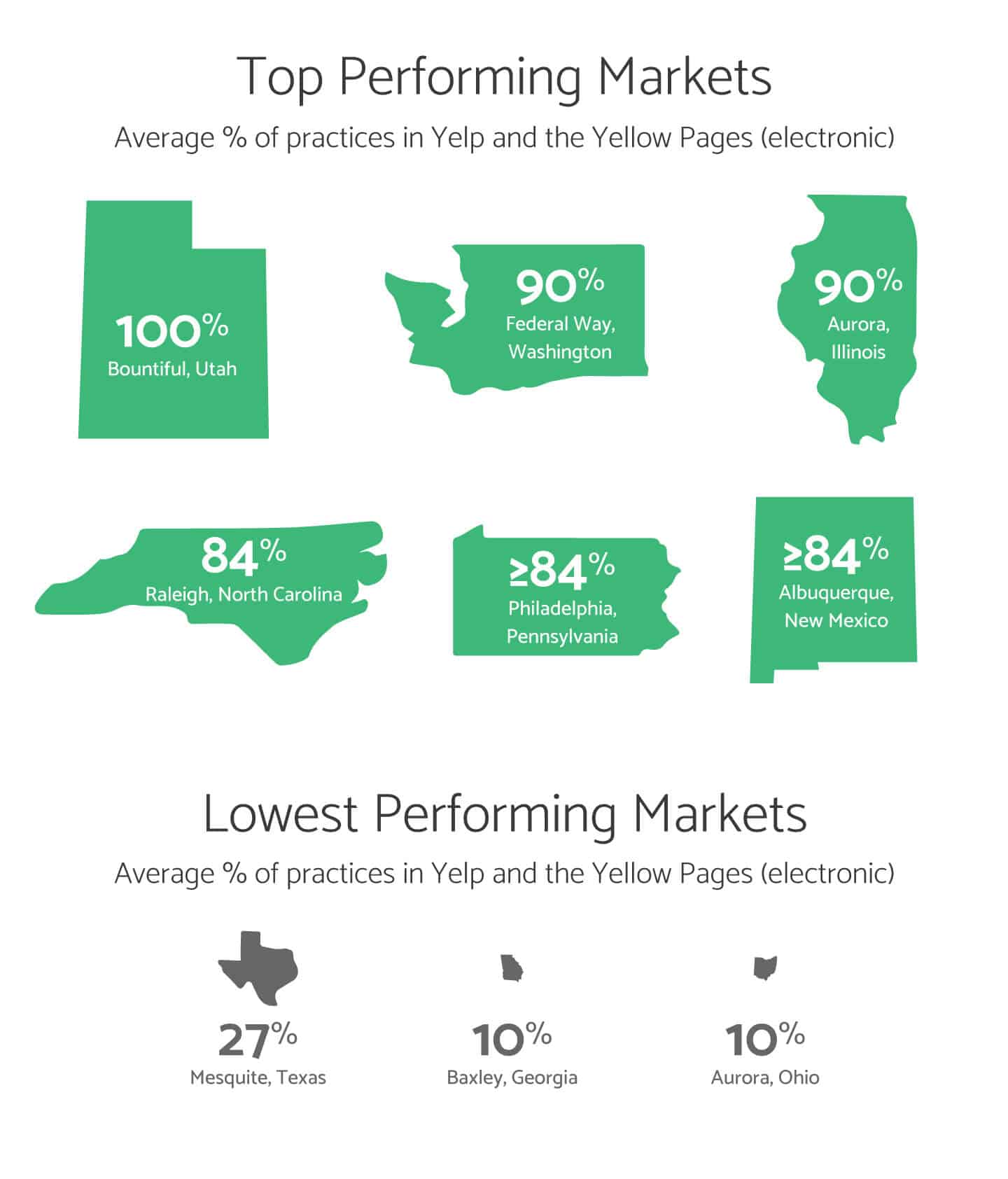

We also found that some local markets perform better than others in directory presence.

Let’s start with the smaller markets.

Among the smaller zones we scored, the best performer was Bountiful, Utah with 100% of practices in both Yelp and the Yellow Pages (electronic). Other regions with over 90% coverage include Federal Way, Washington and Aurora, Illinois.

Some small regions had less than 10% directory presence – for instance, Baxley, Georgia, and Aurora, Ohio.

We also found significant differences in bigger markets (with over 100 competitors). Among these, the best directory presence was in Raleigh, North Carolina with an average of 84% directory coverage. Philadelphia and Albuquerque also saw high rates of coverage.

Of the larger metro areas, the worst performer in directories was Mesquite, Texas (101 competitors) with a high of 27% directory coverage. Other low performers were also clustered in Texas: Cypress, Perland and Spring were also very low in directory coverage.

Organic Search (SEO) Also a Weak Point for Dentists

Today it’s common knowledge that a large percentage of buyers – of any product or service – start out by performing a search, usually on Google. Google presents links in two ways: first, links that are actually purchased ads based on keywords (and are labeled as ads); and then what are commonly called “organic” results, or those that result from Google’s search algorithm picking up links relevant to the user’s search.

Patients are likely to type in “dentist” or “filling” or “toothache,” and then Google serves up links (both ads and non-ads) that are relevant to the search criteria.

Even as many practices may not understand the technology behind search results, they certainly know that a “Google search” is probably going to play into their next patient’s decision on what dentist to see.

Therefore it is surprising that our data shows that 33% (approximately 18,000) of the 54,000 websites we scored had poor organic search results. In other words, their highest ranking in a Google search was not better than 20th place in the list. How many users bother to drill down past all of the ads and then all the way to the 20th entry in search results? The likely answer is: very few – much less than 1%.

Dentists need to work much harder and perhaps hire outside expertise to maximize their SEO ranking. Many agencies specialize in creating effective SEO strategies—and these days it’s about much more than just stuffing some choice keywords into a header (in fact, this practice is actively discouraged by Google). Boosting your SEO ranking may be the most significant improvement your practice can make in its digital marketing effort.

“SEO is search intent – it’s about understanding what a searcher is looking for,” says Samuel Araki, CEO and Founder of digital marketing agency ElementIQ. “The primary focus of SEO seems to be about search engine rankings placements (SERP) – ranking on the first page of Google for example – but it’s more than that. It’s about understanding what kind of services you want business for, and positioning that correctly. It’s not about technical insights that can get your website ranked. This isn’t 2005.”

Rapidly Evolving DMscores Suggest Market Competitiveness

DMscore also noticed some significant differences in the behaviors of dentists in different regions. High volatility in any statistic strongly suggests – or clearly indicates – a high degree of activity. In our case, high volatility in DMscore rankings suggests that dentists in high volatility markets are rapidly working to perform better than their competitors in the same market.

Using a proprietary competitive index, we found that the Los Angeles market seems to be the most competitive. It ranks highest with a score of 71.9 on our index. The index is based on how often rankings change month-by-month. Houston is second with a ranking of 64.2, followed by New York City with 53.3. The market that showed the least volatility was Dallas, Texas with a ranking of 27.7.

While the reasons for these differences remains unclear, one thing is not. And that is the fact dentists in every market need to know their score, monitor it, and try to find ways to improve it.

If you’re in a very competitive market, you know you’ve got to keep up the pace or fall behind your competition. In a less volatile market, the message to dentists is that you may find you can increase your traffic more than you thought just by doing the basics – because many of your competitors are leaving things to chance.

Adwords Spending Peaks in Surprising Places

Conventional wisdom might suggest that heavy ad spending would be in the biggest and ostensibly the most competitive markets. But conventional wisdom would in this case be mostly incorrect.

Our list of the most active regions in the purchase of Google Adwords contains only one major metropolitan area—New York, NY. In fact, the top Adword-spending location is Austin, Texas. Also included in the list are places like Plantation, Florida, Gaithersburg, Maryland, and Phoenix, Arizona.

This suggests a couple of insights. New York is often an anomaly, and also happens to be a town that takes advertising more seriously than most – so it’s little surprise that competitors here are not afraid to spend dollars on Adwords.

Beyond that, Adwords in other major markets may be so expensive as to be prohibitive for all but the largest dental practices. Second, that major markets may be more static than smaller markets. In other words, there may be major, dominant players in big markets – so dominant in fact that they discourage smaller players from even competing. This is a less-likely scenario in markets in lower tiers.

“Paid search, and Google Adwords in particular does work,” Araki says. “In almost any market size, with even minimal budgets, opportunities are there. It just requires some expertise, exacting discipline and laser focus to realize success. One key tip is to start advertising one or two key service areas.”

Top Performing Practices

Perhaps it will come as no surprise that the clear overall leader in digital marketing is a nationwide dental practice called Aspen Dental. Its own marketing claims to represent over 600 dentists nationwide. Its DMscore prominence rests on the fact that over 500 regions in the US count them in their top 10 overall performers for the region. It’s important to note here that all DMscores are calculated regionally in order to maximize relevance. There is no national DMscore for any practice.

Why does DMscore focus so heavily on regional rankings for dentists? Because in almost every instance, the relationship between patient and dentist is local. Even Aspen Dental’s approach is to make sure a patient finds a local dentist. That they can bring to bear the strength of a national outfit to a local competitive landscape only suggests how seriously they take the local nature of dental marketing. In order to capture this important dynamic in our rankings, we have to keep the scores local—in other words, they live in a data universe limited by the market in which they operate.

For the record, Aspen Dental is, according to our data collection, the top Adwords spender in the nation.

What’s Your DMscore?

The above question is likely to be heard more frequently in the next few months and years. DMscore is a neutral, unbiased scoring technology that rates a single marketer’s digital marketing footprint as a trend. It is also a platform for agencies and their clients (today, dentists only) to find common terminology that everyone understands.

“DMscore will provide an overall as well as specific channel scores. Even if your overall score is pretty good, your competition might be better with organic search,”says Schulman. “You don’t have to run your own inexact social experiments by Googling your own practice to see where you rank in relation to your competitors. With DMscore, if you are a 21 in organic search, and your competitor is an 89, your score objectively indicates that you can – and should – do much better there.”

These days, it only makes sense for a dentist to hire an agency to manage their digital marketing – it’s simply too complicated for a practitioner to successfully deploy. One of the major stumbling blocks in outsourcing is a lack of common understanding of success.

DMscore is built to defeat this lack of focus.

With DMscore, both agencies and clients can understand what needs improving, and then watch to see whether the DMscore has changed as a result of improved marketing efforts. For deeper, more detailed statistics on marketing success, we recommend using digital analytics (Google/Adobe) to understand user behavior and conversions from prospects to customers.

Says Schulman, “Not only does DMscore give you in-depth insight into your digital marketing, you can use us to keep your agency in check too.”

With DMscore and detailed digital analytics, any marketer should be able to have a very clear idea about where their marketing can improve, and where user behavior is headed.