Practices took a step back during COVID-19 — how will they forge a new path now?

COVID-19 brought major changes for every industry in 2020, and US dentistry was no exception.

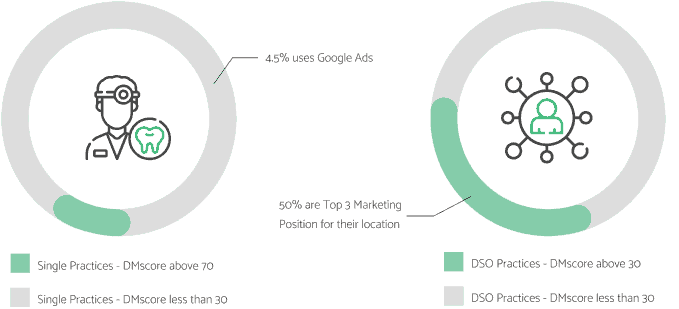

According to new research from DMscore™, marketing by dentists dropped significantly in 2020. Single practices struggled for visibility the most — only 1.44% of single practices had a score over 70 (out of 100) in December 2020. Over 50% of them had scores under 30 — and only 4.5% of these were buying Google Ads. By contrast, 32% of large practices and DSOs had higher scores (over 70 out of 100) and 50% of DSO offices were in the top three marketing positions for their location.

DMscores dropped meaningfully across all sectors in 2020. Compared with April, December 2020 saw a larger concentration of scores in the lowest range (0-30). The general downward shift in scores, including DSOs that continued to spend, was at least 5% across the board.

Like a FICO™ score, DMscore’s Enterprise platform delivers marketing visibility and competitive analysis to the dental market, ranking over 70,000 dental practices against regional competitors on a scale of 1 to 100.

Perhaps not surprisingly, scores tend to favor larger practices, where marketing efforts are often given more attention. DMscore research data strongly suggests that larger (multi-location) practices and Dental Service Organizations (DSOs) consistently spend more on marketing. This level of effort yields a higher score, with the score itself serving as a bellwether for practice viability.

In 2020 during COVID-19, marketing activities were reduced across the industry, and so were DMscores. Single practices with very good DMscores (70-100) dropped by 11% between April and December 2020. It made sense at the time for practices to pull back on all types of spending during what amounted to a national lockdown, but with an increasing velocity of vaccinations, some players may decide to “hit the gas” on marketing in order to pull ahead of competitors.

Only Strong Dental Practices Survive as COVID-19 Spreads

All of the above notwithstanding, the current macro-trend in the market is consolidation. Except for certain well-established single practices with a large, loyal base of customers, single and small practices are facing difficult choices. Practices in this position are either poised for growth; ripe for acquisition — or, if they cannot raise both visibility and profitability, then they may face a gradual loss of business that eventually leaves them without viable practices at all. Prior to COVID-19, DSOs were already buying practices in almost every market, and with COVID-19 rendering more practices vulnerable, this trend is likely to accelerate in 2021.

DSOs showed a very consistent reaction to the COVID-19 lockdown. More specifically, 85% of DSO offices turned off their ad campaigns during their region’s lockdown periods, and most of them reactivated those campaigns instantly when the dental offices re-opened. Only 5% of DSO offices have not recovered their paid score entirely, while another 7% have achieved partial recovery.

The most significant drop was in advertising spend, which came as a result of both single practices and DSOs stopping advertising altogether during the nationwide COVID-19 lockdown period. Comparing December 2020 with April of the same year, single practices’ spend on ads dropped 25% — although, to be clear, the total percentage of single practices buying ads never was above 6% overall. At the same time, DSOs on a much larger spending platform pulled back by about 20%, falling from 52% of DSOs to 41% of DSOs.

In any case, it seems that DSOs generally managed the pullback in a more strategic manner. Rather than disappearing completely, DSOs cut back more tactically — but they retained a marketing presence that, although smaller than their prior level of engagement, still left them well-ahead of the underperformers in the single-practice range. Single-practices with high DMscores (70-100) were always a small percentage of the whole (only 2.3%), and so a drop of 11% left them at a paltry 2.1%. DSOs also pulled back — and they pulled back even more on a percentage-basis than lone practitioners. However, they had started out with such an advantage that even with a sharp pullback, they still dominated the high DMscore category. The percentage of DSO practices in the 70-100 range dropped from 45% to 32%, representing a huge drop of 25%. But, while that was a considerable shift, consider that DSO practices still occupied the top spots 32% to 2.1% compared to single practices! This only underscores the marketing prowess of larger organizations in good times and bad.

DMscore Benchmark Data

Careful analysis of these marketing trends strongly suggests that marketing visibility — as measured by DMscore — is a hallmark of a successful practice. It also suggests that larger practices and DSOs exercise more strategic control over their marketing, and that their ability to spend more heavily on ads drives their visibility and their scores. Further, the data suggests that ad spend itself is a leading indicator of practice viability. Organic search and directory presence may not generate easily trackable spending data, and they also require time and effort. There is a statistically significant correlation between low ad spend and low effort on other marketing activities — which certainly makes sense. If a practice is slow to spend on ads, they are likely also slow to spend both effort and dollars on other marketing activities.

More than anything else, the data points to a widening gap between the “Haves” (DSOs) and the “Have-nots” (single practices) in America’s dental industry. In an age of consolidation and COVID-driven resurgence, it seems clear that the winners will be the spenders. And that very likely means that DSOs will continue to build on earlier successes by buying up other practices in an accelerated manner. In the meantime, small, single practices must step up their marketing for two reasons: first, to expand their market footprints and remain viable as businesses, and, second, to make their practices more attractive to DSO buyers.

Finally, with DMscore establishing itself as a leading indicator of practice viability, DSOs may find themselves looking at DMscores to help them decide which practice or regional market makes the most sense to acquire or invest in. In fact, it is a real possibility that DMscore becomes part of the standard due-diligence toolkit for practice-acquisition.

About DMscore

The DMscore (Digital Marketing score) technology was created by industry visionaries and executives who helped build the first Digital Analytics companies and FICO platforms. The DMscore Enterprise application creates marketing insights for B2B marketers across markets.